Life after your Fixed Rate mortgage: Why plan ahead of your fixed rate ending?

Posted by siteadmin on Monday 12th of June 2023

Life after your Fixed Rate mortgage.

Why plan ahead of your fixed rate ending?

The earlier you plan your remortgage, the more mortgage options you have! And in the current economic climate, it really does pay to know your options. An expert adviser can find the deal for you.

If you’re due to remortgage in the next year or so, take a look at our handy list of does and don’ts that will help you plan ahead with confidence.

- DO give yourself time to weigh up your options. Leaving anything to the last minute can be incredibly stre...

Life after your Fixed Rate mortgage: What happens when your mortgage deal expires?

Posted by siteadmin on Thursday 18th of May 2023

Life after your Fixed Rate mortgage.

What happens when your mortgage deal expires?

If the end of your fixed rate mortgage is on the horizon (even if it’s months away), then it’s a good idea to start looking at your options today.

If you haven’t got a new deal in place when your fixed rate mortgage ends, your lender will put you onto their standard variable rate, which tends to be higher than the rates on most other mortgage options. So it pays to get the right mortgage for you in place.

When it comes to remortgaging, some people ...

It's not all fixed rates

Posted by siteadmin on Friday 14th of April 2023

With over 10 years of record low interest rates, fixed rate mortgages offer borrowers the stability of knowing what the mortgage payment will be for a set period, which helps with budgeting.

Because of the way many lenders decide what rates to offer, we’re currently seeing tracker products priced a lot more competitively than fixed rate products.

Unlike a fixed rate, the monthly payment of a tracker mortgage fluctuates and the rate charged on the mortgage ‘tracks’ the Bank Rate usually for a set period. Whilst you may have to pay a penalty...

Start of the tax year checklist

Posted by siteadmin on Thursday 6th of April 2023

The new tax year on 6 April 2023 is a great time to review your finances.

The new tax year means annual allowances are reset and ready to be reused – to help you make the most of your money. This year more than ever, with interest rates and inflation on the rise, it’s a great time to review your pensions and investments.

Note: The following figures apply to the 2023/2024 tax year, which starts on 6 April 2023 and ends on 5 April 2024.

ISAs

The maximum you can invest across your ISAs is £20,000 (if it’s a cash ISA, stocks and shares ISA or ...

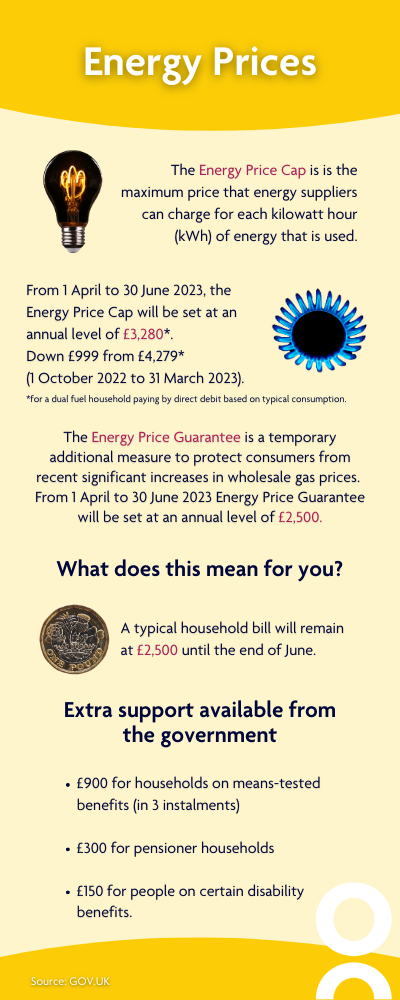

Energy Prices April 2023

Posted by siteadmin on Wednesday 5th of April 2023

OMPS Video Market Update

Posted by siteadmin on Monday 3rd of April 2023

Why diversification is key when inflation rises

Posted by siteadmin on Wednesday 29th of March 2023

To stay ahead of rising costs and maintain your assets’ purchasing power, your portfolio needs to provide positive returns. Diversification can help you achieve this.

What is diversification?

Diversification is investment jargon for the well-known proverb: “don’t put all of your eggs in one basket”. While a well-diversified portfolio doesn’t give you guaranteed downside protection, it can help you maximise long-term growth potential. Since the values of different types of assets don’t always behave the same way or move in the same dire...

Is drawdown right for you?

Posted by siteadmin on Wednesday 29th of March 2023

2 important questions to consider

If you have a defined contribution pension, you can access your retirement savings in a variety of ways. One of those options is drawdown – a flexible approach for dipping into your savings when you need to. Read on to learn more about it.

What is drawdown?

Drawdown is the process of withdrawing a lump sum or a regular income directly from your pension fund, leaving the rest invested in your portfolio. There are some important tax implications to consider with drawdown.

You can access up to 25% of ...

How financial advice adds more value to your life than you may realise

Posted by siteadmin on Wednesday 29th of March 2023

The cost of living crisis is causing many to re-evaluate the benefits of financial advice.

Traditionally, the value of financial advice has been measured by monetary results of investment performance and returns. Today, the cost of living crisis is causing many to re-evaluate the benefits of financial advice.

These days, financial planning is about more than simply looking after your money and protecting your wealth. As well as helping you see results in pounds and pence growth, we can also help ensure you are prepared to meet the ch...

Decumulation: Why a plan is crucial when you start to spend your wealth

Posted by siteadmin on Wednesday 29th of March 2023

Making your retirement savings last a lifetime

To help ensure a sustainable income, you first need to understand how much you’ll need to live on.

- On the go – during the early stages of retirement, there’s a strong likelihood that you’ll spend more on travel, hobbies, or home improvements

- Slowing down – while you may be slightly less active, you’re still busy with hobbies, but you may be less inclined to long-haul travel

- Coming to a stop – in later life, your mobility may be more limited, and you may require care.

Structurin...